Introduction

As this website is about learning and wealth, thought that it might be an idea to write an article on change your spending habits and start saving money, it is also a follow on from my previous article ‘what are good and bad habits’.

Most if not all of us are guilty of spending money when we should not be doing it, it does not matter if it is a bar of chocolate, an extra drink in the bar, another bottle of wine in the restaurant, so it goes on.

We would all like to be able to save money, this could go to any manner of things, a nice holiday, a day or night out, if you save enough even a new car. What about planning for retirement, if you have not already either retired, or have a good pension fund set up. Even if you are retired a little extra in the bank is always handy.

When we were scammed some fifteen months ago and the bank accounts emptied, we had a long chat about how to put money back into the account, my wife reduced her housekeeping, I reduced my spending money, we started to shop at the cheaper shops, two of my hobbies, which are really an investment to leave to our two grandsons, have had nothing added. This has proved to be very successful in building the account up to where we can breathe a little easier.

During the winter our backdoor, became so rotten that it nearly fell off, we were going to replace it before we were scammed, never got round to it, the attitude was we have got money we will have it done, no rush. With our prudent approach to spending, guess what we now have a lovely new u PVC back door, with side panel, which we were able to pay cash for, we are getting things back to normal. The case is not yet resolved, but our attitude is the money has gone, let us just get on with our lives, we have been penniless before.

Where Do You Start?

What a good question, how about sitting down with your partner, also children if you have them, certainly if they still live with you, with a sheet of paper draft out just where the money goes in an average week. You have to be very honest here. If the children normally have a set amount of money each week, is that all they have? Do you give them extra for say the cinema, or other little treats that they have.

Housekeeping, does your partner have a set amount to spend each week on food, are they careful not to exceed the budget, if not why not. Usual items such as Council Tax, Gas, Electricity, Phone Bill, Car expenses, all these need to be considered. Do either of you smoke or drink? If so how much do you spend on these items. Is your personal spend the same each week, or do you have a little extra for an extra pint, or packet of smokes!

Having a Plan

Once you have made a list of the outgoings and income available, be honest and analyze each item that you spend money on, is it really needed, this where you must make your plans to reduce the outgoings, if you cannot increase the income. It would of course be nice to decrease the outgoings and at the same time increase the income.

One suggestion that I have read about is to make a monthly budget planner, either use a spreadsheet, or download one, there are a number available online for free, often known as finance trackers.

You must note down everything that you spend, with receipts, if you do not have one, then note down what the item was spent on and the cost.

It is not a bad idea to spend a few minutes at the end of the day going through what has been spent where. If you get into the habit of doing this each evening, also annotate each item with an N or W, or need and want. At the end of each month analyze what you have spent, pay attention to the needs and wants. The weekly trip to the Cinema is neither a need nor a want, ditch it, nor is the night out at that ‘nice’ restaurant you both love, ditch that as well.

Making it Work

This is the hard bit, having a plan and sticking to it.

Let us now have a look at where money can be saved:

- Credit Cards: If you use credit cards, do not just pay off the minimum, try to pay off at least double each month, this way you will soon get the total down to zero. If you really do need to have one, try to limit your total on it to around 25 to 30% of your limit, this will also help to keep the monthly interest down.

- Coffee: If you have your coffee each morning at the office nor a cafe, reduce this cost by making your own, if comment is ever passed you can always reply that you have this coffee at home and you actually prefer it.

- Have a Shopping List and Stick to it: Whenever you or your partner have to go shopping you must take a list and only buy what is on it, no impulse buys or that is cheap and will come in handy.

- The Weekly Shop: Are you shopping sensibly, or at the most expensive place in town? Since we were scammed, we now shop at one of the well-known ‘cheaper’ shops and save a lot of money. Cheap does not mean shoddy, we still have good quality food, it is just not always the well-known brands.

- Use Cash: When spending money if you use cash you can then see just how much money you have, rather than the magic card which can swallow up you salary before you know it.

- Check Statements: Whenever you get a Bank or Credit Card statement check it to make sure that it is correct, errors do occur, very often not intentionally.

- Ignore Next Door: By this I do not mean do not speak to your neighbours, but ignore the fact that they have bought a new car or go on expensive holidays, they can probably afford it, you are cutting down your expenses and saving money. Just think when the plan works and you save money, they can be envious of you!

Reaping the Reward

When you can begin to see the efforts that have been made in the form of hard cash you can then decide what to do with it.

No doubt that you, or both of you will come up with plenty of ideas, so will not suggest them here. One thing that I am going to be doing now, is to open yet another savings account, the reason is simple, we have an investment account for our youngest grandson, with the new cash laundering regulations, no longer can we put this in at the Building Society where his account is, it has to be where I have an account and then transferred across. So it will now be a simple matter of paying the money in at the right place. This might not be saving money as such, but it is certainly saving time, as they say time is money!

The money that you have now saved could be put into different accounts, such as holidays, days out, retirement fund and other items that you would like to save for.

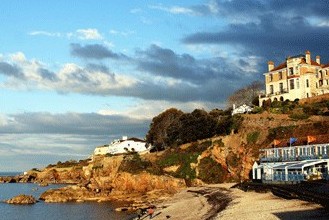

Why not treat yourselves to a luxury holiday with some of the savings!

Conclusion

So hope that you have enjoyed this article, and that it has helped you to look at your finances in a new light.

As always your comments will be appreciated

The next article will be ‘Be aware of the scammer’

.

Be healthy and wealthy

Edwin

https;//learningandwealth.com

Yes, you have some good ideas here. I am glad I dropped in to have a look. One tip I find very useful is to pay myself first. I have a separate Bank Account and into that goes 10% of everything I earn. Keep it separate and don’t touch it for at least 6 months after start-up. This gives you a float which you can use towards money making ventures. Good luck with this. I’ll be back.

Many thanks for having a look also your very sensible suggestion.